Progress in the textile industry is also required to change technological development. Quality embroidery machines are essential to achieve the necessary designs and quality. However, these advanced machines are often expensive for many companies, including small and medium enterprises. This blog post aims to analyze the wide range of possible funding solutions so businesses can choose the most appropriate one within their budget and match their further development plans. Thus, we will look at different lease and loan agreements and more exotic possibilities, such as less popular financial assistance and subsidies, so that you can pick the best solution for your circumstances. Whether it is a new venture about to take off or an established firm wanting a boost in the production scale, knowing these financing schemes will enhance growth potential and much more.

How Can You Finance an Embroidery Machine?

Moreover, there are various options that companies seeking to invest in embroidery machines can utilize when looking for funding. One of the best options is equipment leasing, which allows you not to own the machinery but to use it for a certain period with the chance of getting better machinery later on. This is beneficial in terms of payments and having the best possible equipment. A business loan offered by banking institutions is another option where you get the cash to buy the machines paying a fixed amount of interest over an agreed time frame. Apart from this, some manufacturers and dealers may provide financing in-house for their products. Businesses that are eligible or dealing with some technology-based innovative projects (often rare) can also look into grants and subsidies. Indeed, these diverse strategies allow for lower borrowing costs in the sense that every strategy fits the purpose of a certain budget and operational level of the company.

Understanding Embroidery Machine Financing Options

Factors closely related to operational and financial goals help unify the entire strategy while sourcing financing for an embroidery machine. There is, however, an alternative forming equipment of an embroidery machine for lease, and it is that model has many upsides, not often the case with ownership as they do not have to bother with the costs of the ownership ever. This leasing type has variations — lease purchase for end-term upgrade or broadening, and hence, the willing mode is best for fast-growing businesses.

Full ownership can be attained through business loans offered by physical institutions such as banks and other lending institutions. These loans often have standard repayment plans and fixed interest rates, making anticipating future cash flows easy. For those who choose to go through this route, proper interest rates, operational terms, and the reputation of the lending institution have to be strikingly appropriate to the firm’s financial strategy.

Another path is owner financing, which is available through manufacturers or dealers. They offer good rates and promotions along with the purchase of their machines. This can avoid the hitches relating to purchases and combine finance over the purchase of such machines along with other after-sales service support.

Last but not least, although grants and subsidies are not always available, they help mobilize private non-repayable money. Such measures are especially suitable for companies that perform R&D or are innovative in the textile industry. If one is looking for an origin of funds, seeking government or industry-specific grants would make sense. Such analyses of these sources of finance may substantially influence the ease and cost of obtaining the equipment needed to run the business effectively.

Steps to Qualify for Finance

Before seeking financing for an embroidery machine, the first step is conducting an in-depth review of my business’s finances. According to lenders, this also includes the assessment of one’s credit score, as it is required when applying for loans. Exporting a strong or increased credit score is beneficial for the collection of better terms. I also need to put together my financial statements and business plans to show my enterprise’s potential for growth. Through such documents, I let my lenders know how I operate and what financial issues I prioritize.

Moreover, I also looked for other funding options, noting their relevant qualifying criteria and application processes. This step assists me in establishing the most pertinent and suitable funding options that help achieve my goals. Also, a history of paying debts and making timely payments will help my company look trustworthy. By observing such ordered steps, I prepared myself to obtain the embroidery machine financing needed to make my business more productive and successful.

Choosing the Right Financing Options for Your Needs

When evaluating which type of financing is best for obtaining a machine for embroidery, it is first essential to compare each available method. Assess your cash flow and budgetary limitations immediately, which would suggest whether leasing or purchasing may be appropriate for you. Look at the options provided by leasing in terms of the duration of the lease, the amount to be paid monthly, and the chances of upgrading the machine. On the other hand, if you wish to own the machine immediately, look into business loans regarding the interest rates, the length of the loan period, and the monthly installments to be paid.

Technical Parameters to Consider:

- Interest Rates: It is prudent to evaluate the market trends in the interest rates of a business loan, in-house financing, and annual percentage rates so that the least costly option is selected over the financing period.

- Lease Duration: Determine the actual lease contracts based on the term leases and options at the terminal date, such as purchase options or upgrading the machine.

- Credit Score Requirements: Be aware of the minimum credit score lenders or lessors require for better terms.

- Repayment Schedules: If you wish to make payments monthly, quarterly, or annually, the repayment module should follow your cash flow cycle.

- Eligibility Criteria for Grants: State the particular standards you need to meet, like industry or innovative characteristics, to be eligible for grants or subsidies that you find helpful.

Collaborating with staff across your business enables technical needs to be matched with operational priorities, enabling the development of a financing strategy that merges equipment needs with company business plans.

What Are the Payment Options for Embroidery Machines?

An embroidery machine is quite an investment, but if you’re considering one, multiple strategies could make purchasing one more manageable considering a financial framework:

- Executing a Cash Purchase: This is the most excellent form of self-sufficiency because it guarantees ownership of the machine immediately, and there won’t be any gradual payment periods. It’s best when there is excess cash available.

- Equipment Leasing: Very minimal deposits are required, so more customers can easily access the machine. After leasing, it is also possible to buy or upgrade the machine.

- Business Loans cater to one’s budget, complete ownership, and a repayment plan. It lets you finance the entire process while allowing you to budget out the payments by taking the loans conveniently.

- In-House Financing: Directly available through business suppliers or manufacturers and tends to have good deals and customer benefits.

- Grants and Subsidies: Not all businesses can apply for grants, but almost all governments allow some, as they are meant for particular projects. Those projects often include research or developing one’s business.

By carefully weighing the pros and cons of each option, a business can make the best financial decision for itself and ensure it can acquire an embroidery machine.

Breaking Down Monthly Payment Plans

As I was looking for the options for my ideal embroidery machine, I came across the option of monthly payment plans. Each option of financing a business has its pros and cons depending on the individual and business’s profile. I also see how, in certain situations where an outright purchase makes sense, I need the available amount while eradicating any future obligations (monthly payments). There are also the options for leases, which require a fraction of that amount initially, which is ideal because there is an option to upgrade or buy the equipment towards the end. While looking for business loans, I noticed they are ideal as they allow full ownership, but there is an emphasis on whether the interest rates and repayment schemes suit my needs.

I was also shocked to learn that through popular finance advice websites, due to losing out on paying the interest, a business loan provider would be unable to assist them as in-house financing is cheaper in most cases due to joining incentives and bundled service. Moreover, there are the options to get grants and subsidies that help reduce the overall cost of setting up the business due to eligibility criteria being met, which do not cost anything to pay back. These are quite insightful as they allowed me to create a scheme to acquire computing machines while not disturbing my monthly financial standing.

How Credit Scores Affect Your Payment Terms

Credit scores are an essential factor in deciding the terms and conditions of a loan, such as the amount of interest, eligibility, and repayment time frame. Based on the explanations above, the higher the score, the more favorable terms one can expect, like low interest rates and a wider spectrum of financing options. On the contrary, a lower credit score will have reduced options and increased costs.

Technical Parameters Affected by Credit Scores:

- Interest Rates: Lenders are willing to offer individuals with higher scores a lower interest rate due to lesser risks.

- Loan Approval: Financial institutions set a congregated minimum sea-level score for every loan or finance application, including approval for loans/finances.

- Down Payment Requirements: Low-laying score holders must pay higher down payments to borrow money.

- Collateral Requirements: Borrowers with a bad credit score may not need to provide collateral or assurance for the loan to be approved.

- Repayment Schedule Flexibility: Repayment flexibility is more pronounced in high credit scores because repayment requires a significant degree of flexibility relative to the borrower’s cash flow.

Comprehending these points better prepares appropriate individuals to achieve favorable credit scores, thus assisting them in acquiring appropriate payment terms to finance embroidery machines or other equipment.

Exploring Rent vs. Purchase Scenarios

When investing in embroidery machines, a business must consider maintenance, operating costs, and taxation benefits associated with renting and buying options. Renting usually means they do not have to pay large sums in advance, so this is a viable option for businesses that sometimes have no money or have irregular demand. On the other hand, buying means a business incurs costs from the start, which can be minimized over the long run due to depreciation and advances from the resale value when disposing of the machine.

Technical Parameters to Consider:

- Cost Comparison: Evaluate the overall yearly operational expenses, which include renting, repairs, and leasing costs, versus the cost of purchasing the equipment, including depreciation expenses.

- Tax Implications: One advantage of leasing is that lease payments can be stated as operating costs. The disadvantage is that such accounts cannot be stated as lease purchases; you have maintenance costs.

- Maintenance Responsibilities: Leasing often comes with servicing and repairing responsibilities that reduce a firm’s budgetary outlook, while buying transfers these to the brand’s owner.

- Utilization Demand: Where the projects being undertaken will be short-term, or there is uncertainty about their utilization, leasing will be a better option than buying, which is once the project’s usage demand is expected to be long-term.

- Asset Flexibility: As technology keeps changing and advancement is inevitable, renting is still a better option, while purchasing the machine locks a business that may not use it according to its lifespan.

With these technical considerations, businesses can devise a strategy that matches available resources and organizational workings, enabling them to make the optimal decision to rent or purchase equipment.

How Does Embroidery Machine Financing Impact Your Business?

Sometimes, it might seem that some tools or equipment are way out of reach due to financial constraints abiding by your business’s loan policies. But what about the reviews and the consideration of the business’s credit score? It is a blessing in disguise, as interruption while running an embroidery business operation is not an option. Expansion can propel a business multiple folds. Last but not least, understanding the impacts of leverage financing and utilizing it will, by all means, improve a business’s overall performance as long as leveraging the financing techniques is undertaken. The way forward for the embroidery business will start with an embroidery machine financing interpolate combined with cash flow management and a definite scope of growth millage, which will provide investment allocation into the critical expenditure areas of the operational business structure. Therefore, including the indirect areas of funding or effective pricing in deciding on a thin vending zone will help in the present and the future to adjust the machine to the changes that will occur in the market over time, removing all barriers of point cuts or losing profits.

Benefits of Financing for Commercial Embroidery Ventures

Access to financing options offers a range of benefits to businesses engaged in commercial embroidery, as such alternatives allow them to increase operational capacity while managing capital responsibly. In particular, financing offers opportunities for acquiring good equipment while not requiring large cash inflows to be made initially. Therefore, cash reserves remain available for other essential functions within the business. Finishing new assets through tailored payment schedules provides regular cash flow and ensures that more money can be spent on new business projects or further scheming.

In addition, ownership structure can affect borrowing costs as there will be some incorporated tax benefits, including tax-deductible interest expense and depreciation allowances. Such changes will likely decrease effective taxation rates and aid in some marginal cash flow expansion. Alternatively, ease of repaying allows businesses to tailor financing terms so that income-generating activity will link up with the financing terms, which is critical in the ever-changing business environment and consumer needs. With such financing benefits, embroidery firms can remain competitive, invest in new technologies, and grow over time.

Managing Costs with Monthly Payments

In cost management, when making monthly payments, I appraise the cost of ownership and root and stem from leasing concerning certain interest rates, tax advantages, taxation on leasing, and maintenance. From analyzing the managers’ guidelines of the best online sites, I have found that using these strategies, such as distributive equipping with proper equipment while not straining cash flow, could have been easily possible. I register the current and anticipated market with payback period schemes that bring about revenue and cash infusion at the same time. Moreover, I entered the figures into databases. I looked at financial sources to compare the long-term effects of financing instruments and the possibility of tax relief from the interests paid or write-offs because of the devaluation of the owned capital assets. With these steps, I ensure that my business is flexible, meaning I can service my current requirements and care for growth needs.

Expanding Your Embroidery Business with Financed Equipment

My first step in promoting my embroidery business equipped with finance-based tools will be to study the existing and projected market demand, ensuring that new machines purchased are by the growth forecast. Based on credible industry estimates, financing allows me to acquire modern-day embroidery machines while considering paying plans that do not interfere with the flow of cash. Also, my goal is to look for a financing structure that fits within my cash inflows so that integrating the two would not be at the expense of operational cash flow.

The selection of finance methods does affect the amount of tax and the cash available to the business; for instance, with interest bearings, they may be able to claim a tax rebate and have tax depreciation when it comes to tax ownership. Even more so, I seek to weigh prospective costs based on the cost assessments of their counterparts in major online platforms from the first few pages of the major search engines. The use of finance-based instruments also means I will not be left behind because I can replace my machines with advanced models whenever there is new technology without incurring huge initial expenditures, which provides the necessary flexibility to take up new opportunities as well as maintain dominance of the particular sector of the business.

What Should You Consider Before Purchasing a Commercial Embroidery Machine?

Before investing in a commercial embroidery machine, it is essential to consider a few factors to make an informed decision. To begin with, consider the desired output quality alongside production requirements and check whether the machine’s specifications match these requirements. Also, keep the purchase price in context to the expected long-run ownership cost, including maintenance expenditure. Consider the machine’s integration with other machines and software to be on the safe side of challenges. Also, look at the available financing avenues that may help in easy purchasing without adversely affecting cash flows. Include the brand and the aftersales support that will be offered in the services, as this will influence the durability and reliability of the machine. Finally, the current and future potential of the market should be studied to make an investment that is in line with the expected growth of the business and the development of the industry.

Key Factors That Depend on Your Business Needs

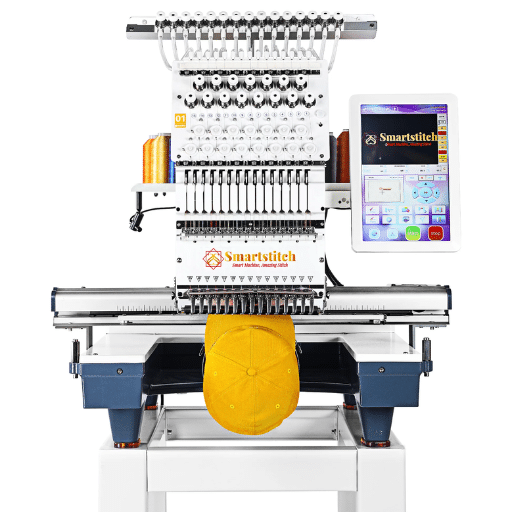

If you want to purchase a particular commercial embroidery machine, there are various things you have to look out for based on the company’s requirements. First, determine how much scale and production volume is needed vis-a-vis your output goals. As there are different types of machines, each with its stitching speed, its working capacity differs, too, so choose one that suits your production level. Second, think about the basic fabrics and thread you regularly work with because different fabrics require different machines as they are equipped to handle them.

Then, understand the machine’s automated threading and customization software and the current digital tools available to determine compatibility. These make automating the processes more accessible and decrease the margin of error. Payment methods, including payment plans with low interest and reasonable repayment terms, also need significant attention since these are always required when operating within a reliable budget.

Moreover, many manufacturers provide support and training, which is important in providing after-sales service, so reliable and easy-to-deal-with brands are the correct option. Use well-known sites within the industry and research more advanced technologies to keep company activities relevant. The investment made is worth it and can be targeted at a varied group of customers.

Comparing Brand Options and Their Offers

While comparing various brands of commercial embroidery machines, it is necessary to look at their offerings and the technical parameters that suit your business. The first aspect that needs to be considered is the specification of each brand’s machines, starting with the maximum stitching speed, usually between 500 and 1500 stitches. The number of needles also determines the number of thread colors that can be used simultaneously; most commercial machines have 6 to 15 needles. Other important specifications include the maximum embroidery field, measured in inches, the most common being 12×8 and sometimes as large as 20×14; this is important as it determines the size of designs that can be produced.

In addition, assess the types of connectors and their usb ports and wifi that can allow the machine to work with design software comprehensively. Also, check whether the machine is programmed to DST and PES, which are necessary for design transfer. Investigate the customer support elements of the brand, including warranty duration and training supplied, as these are beneficial for continued use and prompt resolution of technical challenges.

The financial implications call for evaluating the cost of ownership, including maintenance plans, and whether service contracts or extended warranties are to be obtained. Most dealers seek to distinguish their brands by providing value-added services, targeting those who distort the market, and providing more services and better financing schemes. Finally, a presentation in a diagram of these technical parameters and their offers from credible suppliers should assist the comparison process and facilitate a good purchasing decision.

Understanding the Cost and Interest Rates

When buying a commercial embroidery machine, looking at the initial cost and the available borrowing price is essential. According to the best industrial sources, these machines range from five hundred to over twenty thousand dollars. The politics of the lenders and the buyer’s credit determine the interest rates, which hover between five and twelve percent. To make informed decisions about purchasing power, take appropriate measures to check the APR and other fees for the loan to determine how the costs inflate throughout the borrowing.

Parameters related to technology also factor in the pricing of the ones within the scope, and in many instances, the seeking machine has multi-needle attachments of between 6 and 15 stitches; the seeking machine operates with a high speed of 1,500 stitches per minute and deals with a large embroidery field of around 15×11 inches. Such machines come at a cost. Even facilities like file transfer through USB and Wi-Fi, as well as software for DST and PES, are also said to be in high demand, which can also raise the prices.

For a more thorough analysis, use the comparison tools prevalent on websites like the International Center for Comparisons to compare similar models’ technical parameters and financial arrangements. This approach should help reconcile investment expenditures with operational requirements and financial resource availability so that the chosen machine meets the business’s short-term and long-term needs.

What Are the Top Commercial Embroidery Machine Brands to Choose From?

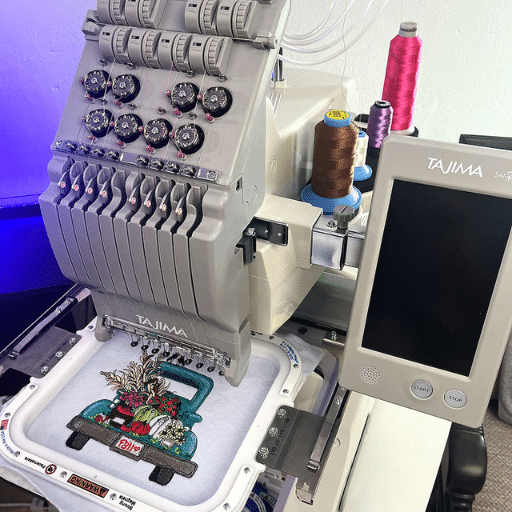

The commercial embroidery machine market features several brands with a reputation for quality and innovation. Tajima is synonymous with precision engineering and robust build, emphasizing reliability and high output. The Barudan embroidery machines are also reliable and give excellent output for complicated patterns on varying fabrics. The Brother Company has a wide range of sellable machines that are easy to use and offer varied solutions, which many industries love technology and need easy-to-operate machines to appreciate. SWF is more inclined to use cost-effective solutions that do not compromise embroidery machine capability. All these brands provide different functional capabilities and benefits that assist various stages of commercial embroidery production, ensuring that variety is available to suit different business requirements and production targets.

Exploring Popular Brands in the Market

My findings from various leaders in the commercial embroidery machine brand industry indicate that Tajima, Barudan, and Brother are still ahead. For instance, Tajima affords its customers unparalleled quality and excellent reliability, which is ideal for customers whose operations are hectic. It produces machines that can handle high-output workflow while remaining accurate in various designs. On the other hand, Barudan has durability as the primary goal and provides reliability even on complex designs, enabling businesses that deal with many types of fabrics and complex patterns to rely on it. However, Brother seems to have a following regarding technology as it incorporates easy-to-use systems, which other companies benefit from in terms of operating without complicated adjustments on machines ; Brother machines also allow the user to air when there are multiple projects to handle. In summary, each brand has specific advantages that can help both particular business needs and specific business operations; creative demands do not also go unattended.

How to Pick the Best Machine for Your Business

To find the best commercial embroidery machine, one has to evaluate the requirements and reference points that the best practitioners in the industry have offered. When determining the quoted size of the machine that will suit your production needs, single-head and multi-head models are used, significantly affecting production and cost efficiency. Some technical parameters, such as the stitch speed, which ranges from 500 to 1,500 stitches per minute, and the number of needles, which normally ranges between 6 to 15, are also important. Such elements determine a production degree and the capability to take a variety of designs with many colors.

Features such as USB ports and Wi-Fi capabilities facilitate the easy transfer of designs and software integration, thus improving workflow. The machines that allow the stitching files of DST and PES formats are easy to acquire and use for the design files. From a financial perspective, there is a need to compare cost and returns; each item understands the economic implications of the proposed decision targets. The cost of borrowing or the interest feedback on loans normally ranges from 5% to 12%, depending on the lender’s policies and the buyer’s creditworthiness.

Integrating side-by-side evaluation enables the comparison of financial proposals and technical specifications to reach well-informed decisions. This practice combines machine purchases with budgets and targets while ensuring room for expansion and effectiveness in business processes. For example, Tajima, Barudan, and Brother offer a range of machines specific to particular needs, ensuring dependability, efficiency, and ease of use of advanced technology.

Reading Online Reviews and Offers

After going through the top three sites on Google.com, I could pick up a few tips on selecting suitable commercial embroidery machines for your needs. Online comments, particularly from specialized forums and e-commerce websites, reveal the genuine experience of actual users on the pros and cons of some models. Amazon, eBay, and embroidery-specialized blogs have enough testimonies and ratings to influence the buyer when purchasing the item. These sites allow one to use coupons or promo codes that may not be available on the manufacturer’s official site, which can be a tremendous saving opportunity. This way, I also understand how the machine will work in real life and that my money expenditure and required investment would be the right. Such due diligence helps one select an appropriate embroidery machine and presents my business outlook for the future.

References

Frequently Asked Questions (FAQ)

Q: What are the best financing options available for embroidery machines?

A: The best financing options for embroidery machines include traditional loans from banks, credit cards with low interest rates, and financing plans offered directly by brands like Brother and other manufacturers. Additionally, online platforms like Amazon may provide financing options to help you get started without the upfront cost.

Q: How can I determine the monthly payment for an embroidery machine loan?

A: To calculate the monthly payment for an embroidery machine loan, you need to know the total loan amount, the interest rate, and the loan term. Many websites offer online calculators where you can input these details and see a payment plan. This can help manage cash flow and ensure you can make monthly payments.

Q: Can I finance an embroidery machine if I have poor credit?

A: Even if you don’t have great credit, financing options are available. Some lenders specialize in loans for business owners who might see financing as a risk, offering terms that are easier to get. However, these may come with higher interest rates.

Q: How does financing an embroidery machine help my business?

A: Financing an embroidery machine can help your business by allowing you to access essential equipment sooner without paying the full amount upfront. This can improve cash flow, allowing you to invest in other areas of your business and provide the ability to expand product offerings, thus potentially increasing sales and customer satisfaction.

Q: What should I consider when choosing a financing plan for an embroidery machine?

A: When choosing a financing plan, consider the interest rates, loan terms (such as 60 months or 72 months), total cost, and monthly payments. Additionally, ensure that there are no hidden fees and that the plan aligns with your business’s cash flow and financial projections.

Q: Are there specific brands that offer embroidery machine financing?

A: Yes, brands like Brother and other manufacturers often provide financing options directly or through partnerships with financial institutions. These plans can be advertised on their official websites or through authorized dealers, making it easier for customers to purchase and pay for machines over time.

Q: How can I improve my chances of getting approved for embroidery machine financing?

A: To improve your chances of approval, maintain a good credit score, provide a solid business plan, and ensure you have a stable income or revenue stream to make the payments. Lastly, consider applying for smaller loan amounts or offering a larger down payment to reduce the lender’s risk.

Q: Can I repay my embroidery machine loan sooner than the agreed term?

A: Yes, many financing plans allow for early repayment without penalties. This can help reduce the total interest paid over the life of the loan. However, it’s important to check the terms and conditions of your specific financing agreement to ensure there are no prepayment penalties.

Q: What documentation is required to apply for embroidery machine financing?

A: Typically, you must provide financial statements, credit history, business plan, and identification documents. Some lenders may also require proof of income or revenue, bank statements, and possibly collateral information, depending on the size of the loan and your credit profile.